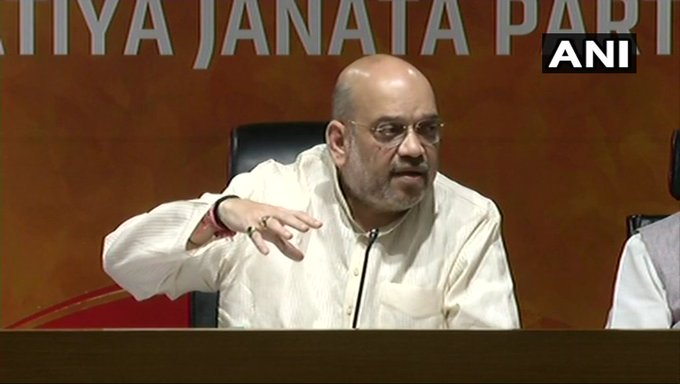

The BJP president said, "In the next 2-3-4 days, the workers sitting in the government will certainly try hard to find some formula or solution." The petroleum minister has told this.

While the government is constantly criticizing the rising prices of petrol and diesel, the oil companies have to come forward and come clean on this issue. Today, in the Press Conference of Indian Oil Corporation, Chairman Sanjeev Singh said that there was no direction to increase the price of the government for not getting the price of oil for 19 days during the Karnataka elections. This decision was taken by the oil companies themselves. Even earlier, oil companies were constantly hiking prices and the decision to stop the increase in prices was themselves by the companies.

Petrol, diesel, can be stepped up this week to relieve the rising prices. The government

has given us the freedom to change petrol and diesel prices on a daily basis, and the companies themselves decide on increasing fuel prices. We believe that all petroleum products should be in GST

Sanjeev Singh also gave financial figures this year and said that after the tax payment in 2017-18, the profit was 21,346 crore, whereas in the year 2016-17, the company had a profit of Rs.19,106 crore.

While raising the price of petrol and diesel, the Congress, targeting the Narendra Modi government, said that the Central Government should reduce excise duty on petrol and diesel and reduce the VAT to the public so that the common people can get relief.